PETROLEUM STORAGE LICENSE | FORM XV / FORM XIV

A business or organisation involved in the import or storage of petroleum has to mandatorily obtain a PESO license in Form XV or Form XIV. According to the Petroleum Act of 1934, there are three sorts of petroleum classes: Class A, Class B, and Class C.

1000+

Satisfied Clients

3000+

Project Completed

10+

Years in Business

Book a Free Consultation Call!

Petroleum can be defined as any liquid hydrocarbon or hydrocarbon combination, as well as any combustible mixture (liquid, viscous, or solid) containing any hydrocarbon, and includes natural gas and refinery gas. According to the Petroleum Act of 1934, there are three sorts of petroleum classes: Class A, Class B, and Class C.

“Petroleum Class A” refers to petroleum with a flash point of less than 23 degrees Celsius. “Petroleum Class B” refers to petroleum with a flash point of 23 degrees Celsius or above but less than 65 degrees Celsius. “Petroleum Class C” refers to petroleum with a flash point of 65 degrees Celsius or higher but less than 93 degrees Celsius.

Any person intending to Store or Import Petroleum of Class A, Class B or Class C has to apply for a license according to the Petroleum Act of 1934. The Petroleum and Explosives Safety Organization (PESO) department, after scrutinising the documents and being satisfied that the requirements of these rules have been met, grants a Petroleum Storage and Import License in Form XV or Form XVI. There is no need for a license to import, transport, or store small quantities of petroleum Class A, as well as to transport or store limited quantities of petroleum Class B or petroleum Class C.

No one shall deliver or ship any petroleum in India to anyone other than the holder of a storage license issued under these rules or his authorised agent, a port authority or railway administration, or a person authorised under the Act to store petroleum without a license.

Petroleum products requiring storage permits include:

CLASS A | CLASS B | CLASS C |

|---|---|---|

Absolute Alcohol | Aviation Turbine Fuel | Furnace Oil |

Acetone | High Speed Diesel | Light Diesel Oil (LDO) |

Benzene | Mineral Turpentine Oil (MTO) | Low Sulphur Heavy Stock (LSHS |

Crude Oil | Styrene | |

Ethyl Alcohol | Superior Kerosene Oil | |

Hexane | Xylene | |

Methanol | ||

Methyl Ethyl Ketone | ||

Motor Spirit | ||

Naphtha | ||

Pentane | ||

Toluene |

Procedure for Obtaining a Petroleum Storage and Import License in Form XV / Form XVI in India:

- Obtaining Login credentials: The applicant must first register and create a Login ID and Password in the NSWS portal to obtain a license.

- Documentation: The applicant must upload all the necessary documents online accordingly. All documents must meet the rules of The Petroleum Act, 1934.

- Fees: The applicant must pay the required fees online as specified in the Petroleum Act, 1934

- Prior Approval: After proper documentation, the PESO department will give Prior Approval to start the construction of the premises as per the approved plan layout.

- Construction: Once the Prior Approval is received from the PESO, the applicant shall start the construction of the storage shed

- Grant of License: The licensing authority after scrutiny of the document, will grant the Final License to the applicant.

Pre - Requisites / Documents Obtaining a Petroleum Storage and Import License in Form XV / Form XVI in India:

- Area: The applicant should have appropriate and ample space for storage of petroleum in Class A , B and C.

- Firms Constitution Documents: Photo ID / Partnership Deed & ROF registration receipt / Certificate of Incorporation / Trust Registration / HUF Deed / Society Registration depending on the type of constitution

- Details of proprietor/partner/ Director/Trustee etc.: Details of proprietor/director/trustee etc. mentioning their Name, Qualification, DOB, Phone Number, and Email id.

- ID Proof: Pan card and Aadhar card of proprietor/partners/directors.

- Agreement: Sale Agreement or Registered Rent Agreement

- Premises ownership documents: Electricity Bill and Property tax Receipt

- Plan Layout: Plan layout drawn as per the PESO rules and regulations.

- DM NOC: No objection certificate from the District Magistrate / District Collector

Obtaining a peso license/petroleum storage and import license in Form XV / Form XVI can be time-consuming and the licensing procedure consists of steps that require a clear and thoughtful method. Any blunder during the registration procedure may result in the applicant being denied the license.

We help our clients in Preparation of Drawing, Applications, Drafting and so on in accordance with PESO Rules, and obtaining an Explosive License for petroleum products such as Furnace Oil/FO, LDO, Diesel/HSD, Petrol, Kerosene/SKO, MTO, Aromax, Cyclohexanone, C9, Laws, Hexane, Toluene, Acetone, Ethyl Acetate, MEK, SBP and so on. We reduce the likelihood of application rejection and ensure that licenses are issued quickly and without complications.

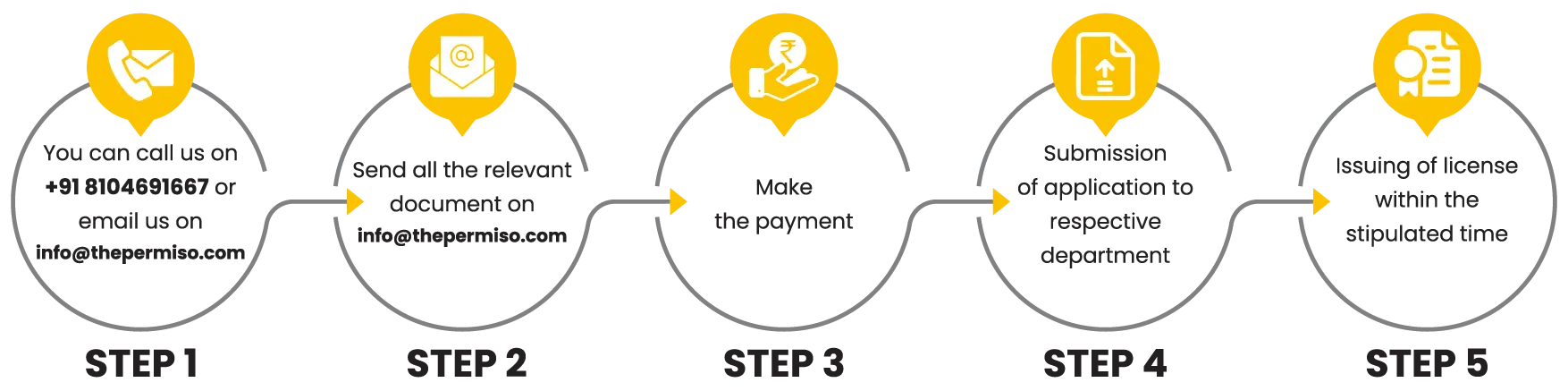

You can apply for a petroleum storage and import license/renewal of license/amendment in license/transfer of license or surrender of license through M/s. The Permiso and obtain the application reference number within 2 days. If you have any issues or facing any difficulty with the application, you can call +91 8104691667 or email us at info@thepermiso.com

Book a Free Consultation Call!

PESO License Registration Procedure