GST Return Filing

GST, or Goods and Services Tax, is an indirect tax in India that has largely replaced numerous other indirect taxes such as excise duty, VAT, and services tax. Parliament passed the Goods and Services Tax Act on March 29, 2017, and it went into effect on July 1, 2017.

1000+

Satisfied Clients

3000+

Project Completed

10+

Years in Business

Book a Free Consultation Call!

GST return filing is the process of providing information to the government regarding your business transactions and tax liability under the Goods and Services Tax (GST) system. For firms registered under the GST regime, filing GST returns is an essential part of GST compliance. Depending on the nature of the business, all GST- registered organisations must file monthly or quarterly GST filings along with their annual GST return. These GSTR filings are completed online through the GST portal.

There are 13 GST returns. GSTR-1, GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8, GSTR-9, GSTR-10, GSTR-11, CMP-08, and ITC-04. However, not all returns apply to all taxpayers. Returns are filed by taxpayers dependent on the type of taxpayer/type of registration received.

Return Form | Description | Frequency |

|---|---|---|

GSTR-1 | Outward Supplies Return | Monthly / Quarterly |

GSTR-3B | Summary Return | Monthly |

GSTR-4 | Composition Dealer Return | Quarterly |

GSTR-5 | Non-Resident Taxpayer Return | Monthly |

GSTR-5A | Return to be filed by non-resident OIDAR service providers | Monthly |

GSTR-6 | Input Service Distributor Return | Monthly |

GSTR-7 | Tax Deducted at Source Return | Monthly |

GSTR-8 | Tax Collected at Source Return | Monthly |

GSTR-9 | Annual Return | Annually |

GSTR-10 | Final return for cancelled registration | Once when GST is cancelled or surrendered |

GSTR-11 | Details of inward supplies to be furnished by a person having UIN and claiming a refund | Monthly |

CMP-08 | Statement-Cum-Challan | Quarterly |

ITC-04 | Goods and Services Tax (GST) Return for Job Work | Quarterly |

Late Fees for Failure to File Return on Time:

GST returns must be filed by the due date, which varies based on the type of return being filed, as defined in the GST laws. If a business fails to file its GST returns by the due date, it may be liable to pay late fees and interest.

Documents / Details required for GST Filing in India:

- List of Invoices (B2B Services, B2C Services)

- Customers GST Number

- Invoice Number

- Place of Supply

- GST Rate

- Taxable Value

- Taxable Value

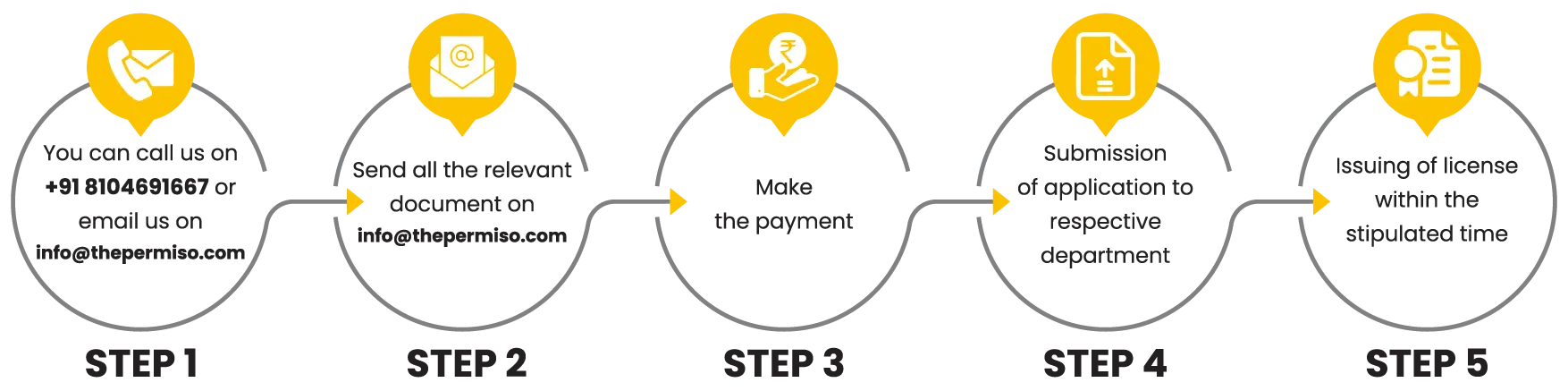

We help our clients in Filing their Monthly GST returns, Quarterly GST returns and Annual GST returns. You can opt for GST Return Filing services through M/s. The Permiso and complete the returns filing within 2 days. If you have any issues or facing any difficulty with the application, you can call +91 8104691667 or email us at info@thepermiso.com

Book a Free Consultation Call!

GST Return filing Procedure